jersey city property tax abatement

Urban Enterprise Zones UEZs are created with the goal of stimulating economic activity in distressed areas. Find All The Record Information You Need Here.

Property Tax Abatements How Do They Work

JERSEY CITY Mayor Steven M.

. Pay the lower amount. As set forth in Executive Order 2015-007 the revised program is intended to build on the success of the current PILOT program and instill greater transparency objectivity uniformity and predictability and to better employ the. The first came in January when the City Council voted to rescind a 15-year abatementon a 30 million residential project Downtown.

You probably wont pay the same as current owner though ring the city they are helpful. Zillow has 14 homes for sale in Jersey City NJ matching 5 Year Tax Abatement. A long-term abatement is a contract that exempts the building not the underlying land from property tax for 10 or more years.

Of this 325 million or about 47 will be funded by city property tax. Jersey City Abatements Dashboard For Taxpayer Advocacy Civic Parent Box 2025 Jersey City NJ 07303. Jersey City Mayor Steven Fulop has announced that the city will move forward with the termination of a tax abatement for four of the six buildings within The Beacon Community at 20 Beacon Way.

To request abatement you must submit the following. Jersey City Mayor Steven Fulop has announced that the city will move forward with the termination of a tax abatement for four of the six buildings within The Beacon Community. The 5-year tax abatement program slowly rolls in taxes from no tax payments in the first year 20 in the second year 40 in the third year 60 for the fourth and 80 for the fifth year.

It cannot be granted in person by phone or through email. View listing photos review sales history and use our detailed real estate filters to find the perfect place. Revenues in 2022 total 695 million.

This law provides for five-year tax abatements to existing and newly constructed residential properties and non-residential structures converted to residential use in municipalities with UEZs. Property tax and Abatement. Chapter 312 of the Texas Tax Code allows municipalities to forge agreements with property developers and owners.

Urban Enterprise Zone Property Tax Abatement. Online Inquiry Payment. Fulop announced today the city is moving forward with the termination of a tax abatement for 4 of the 6 buildings within The Beacon Community located at 20 Beacon Way after the developer Baldwin Asset Associates Urban Renewal Company Baldwin defaulted on its 2005 financial agreement with the City of.

See Results in Minutes. You should send your request for abatement to the address listed on your billing notice. I received the letter from Jersey City 2021 abatement service charge liability.

Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON ST. To process click on Submit Search. The Jersey City Municipal Utilities Authority resolution of January 20 1983 states that all sewerage abatements must be reviewed resubmitted and approved every year.

The City Council will introduce an ordinance revoking a 20-year tax abatement on a five-story residential building under construction at 305 West Side Ave. City of Jersey City. Urban Enterprise Zone Property Tax Abatement.

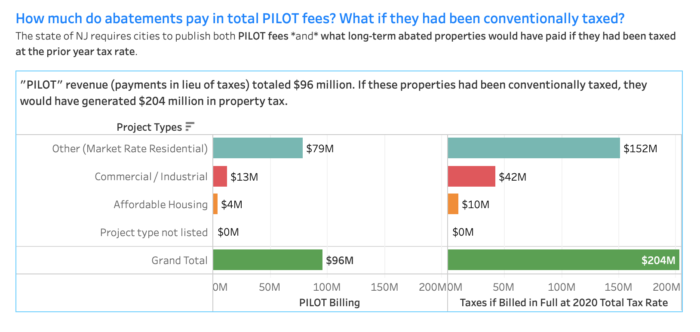

However had the real estate been taxed based on 2020 rates it would have paid over 204 million in property tax made up of 93 million in city tax 55 million in school tax and 56 million in county tax based on the 2020 rates for. Ad Enter Any Address Receive a Comprehensive Property Report. Abatements can only be granted once a penalty has been assessed and the taxpayer is notified billed.

The Municipal Tax Abatement Handbook expands on some of the information provided in the above documents equipping local officials with practical strategies for the exploration of abatements establishment of the municipal redevelopment team and a framework for their roles in the administration and oversight of tax abatements. Left click on Records Search. Unsure Of The Value Of Your Property.

Then in October the city threatened to terminate a 12-year tax. Under Tax Records Search select Hudson County and Jersey City. These 160 abatements projects paid a total 96 million in PILOT fees which primarily funds the city and secondarily the county.

A request for abatement must be in writing. The balance of the city budget 370 million would be funded by other sources including abatement PILOT fees 101 million COVID19 federal aid 70 million state aid 64 million local revenues 41 million and more. The latest iteration of Jersey Citys tax abatement policy retains the tiered structure while making minor tweaks to the policy.

A long-term abatement is a contract that exempts the building not the underlying land from property tax for 10 or more years. Under Search Criteria type in either property location owners name or block lot identifiers.

A New Study Revives The Debate Over Property Tax Abatements

New Jersey S Tax Exemption And Abatement Laws Onhike

Luxury Ads에 있는 化圣 高님의 핀 부동산 포스터

Jersey City To Terminate Tax Abatement With The Beacon Hudson Reporter

What Is A 421a Tax Abatement In Nyc Streeteasy

10 Riverside Boulevard Pha A Luxury Condominium For A Vendre Lincoln Square New York New York Property Id 3738651 Christie S International Real Estate

Dwindling Finds Nyc S Last Batch Of New Condos With 421 A Tax Abatements Cityrealty

Tax Abatements 301 Two Sides Of The Same Pilot Civic Parent

Tax Abatement Series Civic Parent

New Jersey S Tax Exemption And Abatement Laws Onhike

A New Study Revives The Debate Over Property Tax Abatements

Tax Abatement Nyc Guide 421a J 51 And More

New Luxury Building Secures Property Tax Abatement From City But Fails To Qualify For State Tax Credits New Brunswick Today New Brunswick Nj Local News

Property Tax Abatements How Do They Work

As Trump Built His Real Estate Empire Tax Breaks Played A Pivotal Role Npr